Planning for retirement can be challenging, but selecting the right state can make all the difference for veterans relying on their military retirement pay.

Some states offer a significant financial advantage by exempting military retirement pay from state taxes. To be precise, 26 states have state income taxes but don’t tax military retirement pay.

These states provide an opportunity to stretch your income further, ensuring a comfortable and financially stable lifestyle.

Let us see what states don’t tax military retirement pay.

States That Exempt Military Retirement Pay from Income Tax

Several states fully exempt military retirement pay from state income taxes, providing veterans with significant financial advantages. Here’s a detailed look at the states offering full exemptions:

States That Don’t Tax Military Retirement Pay

States with No State Income Tax

Alabama

Alaska

Arizona

Florida

Arkansas

Nevada

Connecticut

South Dakota

Hawaii

Tennessee

Illinois

Texas

Indiana

Washington

Iowa

Wyoming

Kansas

/

Louisiana

/

Maine

/

Massachusetts

/

Michigan

/

Minnesota

/

Mississippi

/

Missouri

/

Nebraska

/

New Jersey

/

New York

/

North Carolina

/

North Dakota

/

Ohio

/

Oklahoma

/

Pennsylvania

/

Wisconsin

/

Each state listed here provides a combination of financial relief and support initiatives that make them attractive for veterans planning their retirement.

These states prioritize easing the financial burdens of those who served in the armed forces, ensuring they retain more of their well-earned retirement benefits.

In Illinois, veterans not only receive tax-free pensions but also benefit from extensive veteran-focused educational and employment programs.

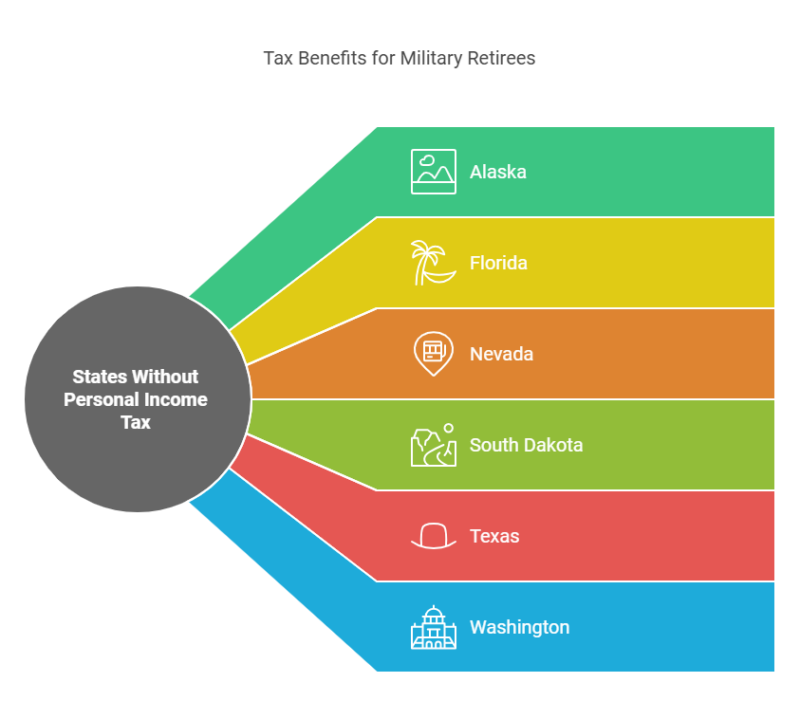

States Without Personal Income Tax

Certain states in the United States eliminate personal income tax, making them highly attractive for military retirees seeking to maximize the value of their retirement pay.

- Alaska: Known for its scenic beauty and no personal income or state sales tax, Alaska offers significant financial savings.

- Florida: A popular retirement destination, Florida does not impose personal income tax, ensuring that military retirement pay is fully protected.

- Nevada: With no state income tax, Nevada allows military retirees to retain more of their retirement pay.

- South Dakota: South Dakota offers tax-free retirement pay along with low living costs, affordable housing, and a supportive environment for veterans.

- Texas: Texas is a well-known veteran-friendly state with no state income tax and relatively low housing costs in many areas.

- Washington: Military retirees in Washington benefit from the absence of state income tax, along with access to robust veteran services and healthcare facilities.

- Wyoming: Known for its wide-open spaces and veteran-friendly policies, Wyoming offers military retirees the advantage of no state income tax and low property taxes.

- New Hampshire: While New Hampshire does not impose a general personal income tax, it does tax dividends and interest.

- Tennessee: Similar to New Hampshire, Tennessee taxes only dividend and interest income, which makes it a tax-friendly state for military retirees.

Benefits of Residing in These States

For instance, Alaska’s absence of both income and sales tax makes it particularly appealing, as does Texas with its combination of tax relief and economic advantages.

States like Florida and Nevada not only offer financial benefits but also provide access to recreational and healthcare facilities tailored to retirees.

Moreover, many of these states, such as South Dakota and Wyoming, are known for their lower cost of living, which allows veterans to stretch their retirement income further. Nevada and Washington, on the other hand, combine tax savings with thriving urban and rural options, offering something for every lifestyle preference.

Relocating to these tax-friendly states can significantly enhance financial stability for military retirees, allowing them to focus on enjoying their retirement without the added burden of state income taxes. Choosing the right movers can also reduce the stress of such transitions, especially interstate ones like the ones in this guide

States That Partially Tax Military Retirement Pay

Some states impose partial taxation on military retirement pay but provide deductions or exemptions under specific conditions.

These policies aim to reduce the financial burden on military retirees while balancing state revenue needs. Here’s an overview of the states and their policies:

Colorado

Colorado offers significant tax relief to military retirees based on age. Retirees under the age of 55 can be exempted from up to $15,000 of their military retirement pay, while those aged 55 and older are eligible to be exempted from up to $24,000.

The progressive exemption structure is particularly beneficial for older retirees who often rely more heavily on their pensions as a primary source of income.

Delaware

In Delaware, the state provides tax exemptions based on the retiree’s age. Retirees under the age of 60 can exclude up to $2,000 of their military retirement pay, while those aged 60 and older are eligible to exclude up to $12,500.

Combined with Delaware’s generally low property taxes and no sales tax, this makes the state a viable option for veterans seeking financial flexibility.

Kentucky

Kentucky provides a high exemption threshold, allowing military retirees to exclude up to $31,110 of their military retirement income from state taxes.

A substantial deduction makes Kentucky an attractive option for veterans seeking moderate tax relief without completely exempting their pensions.

In addition to this exemption, Kentucky offers a relatively low cost of living compared to other states, which can further enhance the financial stability of military retirees.

States That Fully Tax Military Retirement Pay

Not all states provide tax relief for military retirees, and some tax military retirement pay at the state’s full income tax rates, like:

Military retirees must evaluate multiple financial and lifestyle factors before choosing where to settle. One of the most significant considerations is the tax treatment of their retirement pay. While many states offer exemptions or reductions for military pensions, a few tax them at full state income tax rates, potentially affecting long-term financial stability.

Retirees living in these states may face higher tax burdens, impacting their disposable income, investment opportunities, and overall cost of living. Below are some states that currently impose full taxation on military retirement pay:

California

Military retirement pay in California is taxed at the state’s standard income tax rates, which are among the highest in the country. With tax brackets reaching up to 13.3%, California’s tax structure significantly affects military retirees, particularly those receiving substantial pensions.

A high taxation, combined with the state’s expensive cost of living, often drives retirees to consider relocating to more tax-friendly states.

While California does offer some benefits to veterans, such as access to world-class VA healthcare facilities and strong veteran employment programs, the lack of tax relief remains a major financial drawback.

Vermont

Similar to California, Vermont taxes military pensions at its full state income tax rate, making it one of the least tax-friendly states for retired service members. With a progressive tax system that can reach 8.75%, Vermont’s taxation on retirement income places additional financial strain on veterans.

The state offers various veteran benefits, including education assistance and property tax reductions, but these do not offset the full taxation of military retirement pay.

Military retirees looking to preserve more of their income may find other states more financially viable.

Minnesota

Minnesota is another state that does not provide exemptions for military retirement pay, taxing it at rates of up to 9.85%. Despite the state’s well-developed veteran support programs, including housing assistance, healthcare, and employment services, its tax policies can be a deterrent for retirees.

Minnesota’s cold climate and relatively high property taxes further contribute to its mixed appeal for veterans seeking a cost-effective retirement location.

Some retirees may choose to remain in Minnesota due to family ties or healthcare accessibility, but many explore alternative states with better financial incentives.

Connecticut (Before Recent Exemptions)

For years, Connecticut fully taxed military retirement pay, adding to the financial burden on veterans.

However, recent legislation has changed this, offering tax exemptions for military pensions. Prior to this change, Connecticut was among the states where retirees faced full taxation, leading some to relocate.

While the new exemption offers relief, veterans in other states without exemptions still face similar financial challenges.

Financial Planning Considerations

When choosing a state for retirement, tax policies are an important factor but not the only consideration.

Cost of Living

The cost of living varies by state and directly impacts the value of a military pension.

States like Texas and Florida, with tax relief and lower housing and utility costs, offer affordability and a good quality of life.

In contrast, high-cost states like California and New York can diminish the pension’s value.

Key considerations include housing prices, property taxes, utility rates, and everyday expenses such as groceries and transportation.

Healthcare Access

Access to high-quality medical care is essential for retirees, particularly for veterans who may have unique healthcare needs resulting from their time in service. States with strong healthcare infrastructure and access to VA hospitals, such as Florida and Texas, are often ideal choices.

Retirees should assess the proximity of healthcare facilities, the availability of specialized services for veterans, and the quality of care in the area.

States that invest in healthcare infrastructure, especially those with large veteran populations, can offer significant peace of mind for retirees and their families.

Support Networks

Emotional and logistical support networks can greatly enhance the quality of life during retirement.

States with strong veteran communities, like South Dakota, Wyoming, and Florida, provide opportunities to connect with others who have shared experiences.

Proximity to family members also plays an important role, as it ensures access to help during emergencies and fosters meaningful relationships during retirement.

The Bottom Line

Choosing the right state for your military retirement can have a significant impact on your financial well-being and overall quality of life.

By opting for a location that exempts military retirement income from taxation, you can keep more of your hard-earned benefits and focus on enjoying the next chapter

These states offer opportunities for veterans to stretch their income, secure financial stability, and enjoy the rewards of their service.

Make your retirement plans work for you by considering options that prioritize financial relief and veteran-friendly policies.

Sources

- MyArmyBenefits – North Carolina Military and Veterans Benefits

- Texas Veterans Commission – Active Duty in Texas

- Kintsugi – Your Guide to States Without Sales Tax

- Center for New American Security – California’s the only state that fully taxes military pensions

- Tax Foundation – Vermont Tax Proposals Would Leave the State and Vermonters Behind

Related Posts:

- The Hidden Rules of Military Life - What They Don’t…

- Why do Immigrants Come to the United States?

- What Are the Current Swing States in 2025, and How…

- A Look at US Military Helicopters: Past, Present, and Future

- The Rise of Ruggedized Displays - How ViewPoint…

- How to Structure a 12-Week Military Running Program…