Laser weapons have moved out of science fiction and into strategic military plans across the globe.

Speed-of-light targeting, precision accuracy, and low operational costs now define a new chapter in warfare.

With rising investment in directed-energy technology, several nations are racing to claim dominance in a rapidly shifting arms competition.

2025 is a turning point when it comes to laser weapons, with real-world deployments confirming what once seemed futuristic.

- United States

- China

- Israel

- United Kingdom

- Germany

- India

- Russia

- Japan

- South Korea

- Türkiye

Let us talk about each in greater detail.

Table of Contents

ToggleThe United States

Laser weapons development in the United States continues at full throttle, with defense agencies investing heavily across all military branches.

Multiple systems are already operational or in advanced stages of testing. Power levels are increasing quickly, and strategic deployment is expanding.

- DE M-SHORAD and P-HEL: Ground-based systems with 50kW output, effective against drones and light airborne threats.

- HELIOS: Naval system mounted on ships like USS Preble, exceeding 60kW.

- Valkyrie: Under development, aiming for 300kW output to intercept advanced missiles and high-speed projectiles.

Deployment covers both land and maritime platforms, with operational goals focused on eliminating drones and incoming missiles and disabling enemy sensors.

Directed-energy weapons now play a growing tactical role thanks to low cost per engagement compared to traditional interceptors.

- Cost-efficiency: Laser shots cost significantly less than guided missiles.

- Program scale: $1 billion annual budget supporting 31 laser-based initiatives under the Department of Defense.

- Weather interference: Rain, fog, and dust can disrupt beam integrity.

- Power supply challenges: Field operations often lack stable energy sources.

- Platform integration: Adapting lasers to current combat systems requires complex coordination.

China

China’s approach to laser weapons remains deliberately veiled, though emerging evidence paints a picture of rapid development and growing ambition.

Since 2006, reports have suggested that Chinese forces may have targeted satellites using ground-based lasers, indicating early interest in disabling orbital assets.

That initial focus has since expanded into multiple domains, with operational testing of advanced systems now taking place in public view.

Silent Hunter, a vehicle-mounted directed-energy system, is China’s most visible laser weapon. Capable of neutralizing drones and lightly armored vehicles, it reflects a shift toward tactical utility in active combat zones.

Recent sightings of Silent Hunter aboard Type 071 amphibious ships suggest an expanding naval application, allowing for increased mobility and deployment flexibility.

- Silent Hunter: 30–100kW power range, designed for drone defense and light vehicle neutralization.

- Type 071 ship integration: Shows intent to extend capabilities into maritime operations.

- Satellite-targeting systems: Ground-based lasers aimed at disrupting enemy space-based surveillance.

- Dual-use research: Civilian and military labs coordinate development under state oversight.

China’s military-industrial sector continues to invest heavily in directed energy, aiming to develop systems that can interfere with satellite sensors and even disable guidance on enemy missiles during flight.

Western analysts suspect Beijing’s interest in orbital dominance is more than theoretical, with programs in place to operationalize such tools under future space conflict scenarios.

- Beam focusing at long distances: Accuracy degrades over extended ranges without advanced optics.

- Adversary countermeasures: Protective coatings and evasive tactics reduce effectiveness.

- Power supply constraints: Sustained laser firing requires large energy reserves, which complicates use on mobile or space platforms.

Despite those limitations, China has demonstrated intent to compete globally in directed-energy weapons.

Deployment of functional systems already underway suggests it views lasers as vital to modern warfare, with ambitions stretching far outside its borders.

Israel

Israel continues to lead in the development of battlefield-ready laser weapons, with Iron Beam representing a major leap in short-range aerial defense.

Developed through a joint effort between Rafael Advanced Defense Systems and Elbit Systems, Iron Beam delivers 100kW of high-energy output and is specifically designed to intercept rockets, mortars, and drones. Its purpose is to serve as a cost-effective, high-volume supplement to existing air defense systems.

Iron Beam has been engineered to work in direct coordination with the Iron Dome system, which, while highly effective, relies on Tamir interceptor missiles that cost around $40,000 each. Iron Beam dramatically cuts that cost, offering a near-zero per-shot expense.

- Interception cost: ~$3 per laser shot compared to $40,000 for a Tamir missile.

- Energy-based operation: No physical ammunition needed.

- Continuous fire capability: Effective against drone swarms or multiple projectiles.

Field tests have demonstrated high levels of precision and reliability. Integration into the Israeli Defense Forces is expected soon, with rapid response times making the system ideal for intercepting threats in urban areas and during high-volume attacks.

Iron Beam is especially suited to the defense of sensitive infrastructure and civilian zones near conflict borders.

Technical hurdles remain, such as energy demands and weather-related interference. Engineers continue refining the platform to ensure reliability in real-time combat.

Despite those challenges, Iron Beam represents one of the most advanced, scalable laser defense solutions currently nearing deployment.

- Partnerships: Joint development by Rafael and Elbit Systems ensures robust tech and logistical support.

- Operational relevance: Tailored for Israel’s specific threat environment with frequent short-range attacks.

- Scalability: Designed to be deployed alongside mobile and stationary defense assets.

United Kingdom

The United Kingdom is making measurable progress in directed-energy weapons with DragonFire, a 50kW laser system that hit airborne targets during 2024 live-fire trials.

With precision reaching up to 3.4 km and a per-shot cost of roughly $13, DragonFire is positioned as a serious alternative to traditional missile systems. Defense officials consider it a high-value solution for counter-drone warfare and cost-effective interception.

Developed through a strategic collaboration between the Ministry of Defence, MBDA, Leonardo, and QinetiQ, DragonFire reflects a combined push to modernize tactical capabilities.

The system is engineered for quick, silent destruction of aerial threats, offering a critical edge in combat zones where stealth and accuracy matter most.

- High accuracy: Engages targets up to 3.4 km with pinpoint beam control.

- Silent operation: Emits no noise, reducing risk of detection.

- Low cost per shot: Each laser engagement costs approximately $13.

- Clean logistics: No ammunition means simplified resupply and transport.

Development efforts aim to reduce reliance on costly missile stocks and enhance mobility. Deployment options under review include naval ships and mobile ground platforms. Royal Navy tests are expected to expand in scope, particularly on maritime defense systems.

DragonFire is not yet fully integrated into armed forces, but trials show solid momentum. Research teams are focused on energy storage improvements and adapting the system to harsh combat environments.

With continued testing and refinement, DragonFire may soon become a standard fixture in the UK’s defense strategy.

Germany

Germany has centered its directed-energy efforts on maritime applications, focusing on ship-based laser weapons capable of defending against aerial threats.

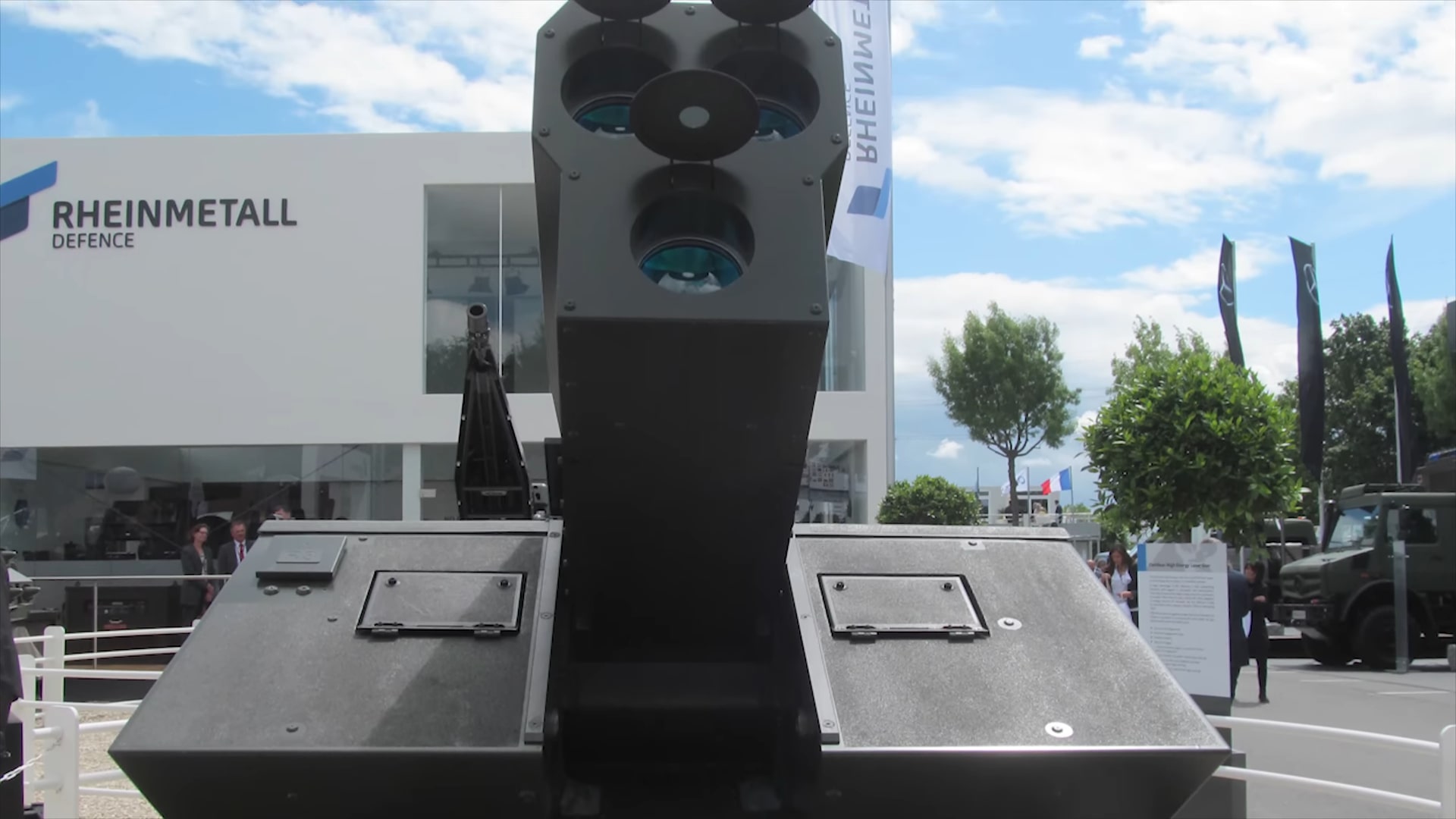

Rheinmetall and MBDA lead the development of a high-energy laser system, with integration and testing carried out aboard the Sachsen F-124 frigate. Over 100 field trials have taken place under varying operational conditions, demonstrating both stability and promise.

Laser Weapon Demonstrator (LWD) serves as the main system in development, designed to target drones and intercept incoming missiles before impact. By situating the platform at sea, engineers take advantage of greater space and onboard power, which helps overcome the energy demands often limiting land-based systems.

Maritime platforms allow for longer operation times without frequent refueling or battery swaps.

- Target scope: Focus on drones, loitering munitions, and missile threats.

- Energy advantage: Ship-based deployment provides reliable power and cooling.

- Strategic role: Protects vessels and maritime infrastructure during saturation attacks.

- Technological focus: Beam precision, real-time tracking, and rapid engagement cycles.

System readiness is anticipated within the next five to six years. Ongoing refinements aim to improve performance in harsh maritime environments, including rough weather and low-visibility conditions.

Commanders view directed-energy weapons as valuable due to their unlimited “magazine,” which allows for sustained defense as long as energy supply holds. Replacing or supplementing missile-based systems with laser fire offers both logistical and financial benefits.

India

DRDO Seeks Indian Expertise for High-Power Laser Weapon Systemshttps://t.co/mUmdKzKGGV pic.twitter.com/cB6jBIic5B

— idrw (@idrwalerts) April 26, 2024

India’s pursuit of directed-energy weapons has gained momentum through concentrated efforts led by the Defense Research and Development Organisation (DRDO). The DURGA II program represents the country’s most ambitious attempt to field a high-energy laser system with multi-domain capability.

CHESS (Centre for High Energy Systems and Sciences) and LASTEC (Laser Science and Technology Centre) are spearheading the project to deliver a 100kW-class laser capable of engaging threats across land, air, and sea.

India’s initial step into operational testing occurred in 2017 with a 1kW prototype that successfully targeted metal plates at close range. That demonstration, while basic, served as proof of concept for further development.

- Power scaling

- Beam accuracy

- Battlefield durability

Key objectives and milestones within the DURGA II program include:

- Targeted output: 100kW-class laser for use on mobile and stationary platforms.

- Intended applications: Interception of drones, low-flying missiles, and hostile aircraft.

- Multi-platform integration: Compatibility with army vehicles, naval ships, and airborne systems.

- Lead agencies: CHESS and LASTEC under DRDO oversight.

Defense officials consider laser weapons critical to addressing asymmetric threats, particularly in contested regions involving adversaries like China and Pakistan. India’s geopolitical environment continues to influence the urgency and scope of its directed-energy investments.

Major technical challenges are still under review.

- Power supply and storage: Especially difficult for air-based applications requiring compact energy solutions.

- Beam stability: Necessary for accuracy over long distances and during mobile operation.

- Weather resistance: Beam performance can degrade in atmospheric disturbances.

Russia

Russia develops new mobile laser gun to target droneshttps://t.co/fNFFPvFcCD

— Defence Blog (@Defence_blog) March 27, 2025

Russia has taken a dual-track approach in its laser weapons strategy, targeting both space-based and battlefield threats.

Peresvet, one of the most prominent systems, entered service in 2018. It is widely believed to be designed for disabling satellites, particularly those involved in reconnaissance and communication.

Reports indicate it can engage targets between 200 and 1,100 kilometers above Earth, focusing on interference rather than destruction.

In recent years, Russia expanded into ground-based tactical applications with the deployment of Zadira. Used during the Ukraine conflict, Zadira was reportedly successful in neutralizing small, unmanned aerial vehicles.

Russian officials promoted the system as a fast-acting, low-cost alternative to missile-based defense in environments saturated with drones.

Operational focus includes both symbolic and strategic value. Russian analysts often describe laser weapons as tools to project technological prowess while disrupting enemy surveillance capabilities.

Military doctrine shows a strong interest in integrating laser systems with radar and existing missile platforms.

- Peresvet: Satellite-targeting system operational since 2018.

- Zadira: Tactical battlefield laser deployed in active conflict zones.

- Altitude engagement range: 200–1,100 km for space-based targets.

- Primary functions: Sensor disruption, anti-drone defense, electronic warfare.

Challenges persist. Reliable power sources are a major barrier, particularly in mobile deployments. Environmental factors like cloud cover and atmospheric conditions also affect performance.

Japan & South Korea

Japan and South Korea continue to strengthen their positions in the global push for directed-energy weapons, each driven by regional tensions and the rise of drone warfare.

Both nations are scaling their efforts through military investment and accelerated technological development, aiming to deploy practical systems for real-world defense needs.

Japan revealed a 10kW laser weapon mounted on an electronic warfare vehicle during a 2024 defense showcase.

- Neutralizing small drones

- Surveillance equipment

- Sensors in tactical situations

The Ministry of Defense has laid out funding pathways to support future variants intended for aircraft and naval platforms.

- Power output: 10kW (current prototype).

- Platform: Mounted on electronic warfare truck.

- Target capabilities: Disables drones, sensors, and low-speed aerial threats.

- Future plans: Scale power for air and sea platforms.

South Korea has made headlines with its Block-I anti-aircraft laser system. With each shot costing as little as $1.50, the system offers a tactical advantage for urban and border defense.

Efficiency, low visibility, and fast engagement times make it suitable for neutralizing aerial threats without drawing unwanted attention.

- Cost per shot: ~$1.50.

- Target use: Intercepts small drones and loitering munitions.

- Advantages: Quiet, stealth-compatible, low thermal signature.

- Operational focus: Short-range defense in populated or contested zones.

Military research and development budgets in both countries have expanded, reflecting urgency driven by external threats and arms competition in the region.

Defense contractors in Tokyo and Seoul are pushing joint programs and prototypes into fast-track testing cycles.

Türkiye

Turkish developed NAZAR Laser system

NAZAR has a tracking capability based on its own on #LIDAR technology, making it highly accurate. It is said to have more range than the Phalanx CIWS.

This will make it possible to neutralize EO/IR-guided missiles from long distances #IADN pic.twitter.com/pAIsVVtW8t

— News IADN (@NewsIADN) July 20, 2023

Türkiye has advanced its directed-energy capabilities through the NAZAR system, which was first introduced publicly in 2012.

Developed by TÜBİTAK and ASELSAN, NAZAR focuses on disrupting optical and electro-optical sensors rather than burning through targets. That approach allows it to interfere with guided missiles and reconnaissance systems without requiring destructive power levels.

Mounted primarily on naval platforms, NAZAR enhances Türkiye’s maritime defense by offering protection against surveillance and targeting systems. It has been showcased internationally at multiple defense exhibitions, reflecting the country’s interest in exporting advanced military technologies.

Officials have emphasized that NAZAR operates in the electronic warfare domain, capable of jamming and confusing incoming threats using high-precision light energy. Unlike more destructive systems, NAZAR aims for long-term operational use in surveillance denial and missile defense through non-lethal means.

Development continues with upgrades to boost power output and expand deployment to land-based vehicles. As Türkiye expands its drone programs and naval reach, directed-energy integration with its broader defense ecosystem becomes increasingly valuable.

NAZAR underlines Türkiye’s intention to become a self-reliant defense innovator in laser technology. Though not yet a frontline weapon, NAZAR’s evolution shows strong potential for expanded capabilities and deployment across diverse combat scenarios.

The Bottom Line

Laser weapons are no longer future projections but operational tools reshaping modern warfare.

Precision, cost-effectiveness, and speed-of-light engagement make them attractive additions to military arsenals.

Nations aren’t replacing traditional arms but are building hybrid strategies for 21st-century threats. Continued investment and testing will define how far directed-energy technology integrates into combat operations.

In 2025, real systems are in the field, and the global race has shifted into high gear.

Related Posts:

- Army Rangers vs Green Berets - Which Elite Force Does What?

- Detecting Directed Energy Weapons - What You Need to Know

- Wing Loong II Drone - A Comprehensive Overview

- Can the US Army Maintain Its Technological Edge Over…

- Why the RQ-4 Global Hawk Remains Vital for the U.S. Military

- What Are the Current Swing States in 2025, and How…